Market Recap For November 10th, 2022

Even though Wednesday looked very bearish, but our Spotlight stated, “today’s CPI could change that”, and it most certainly did.

The rally that started on October 13th remains intact, with an S&P looking to make it to 4K, at minimum. Only a complete reversal today would jeopardize that forecast.

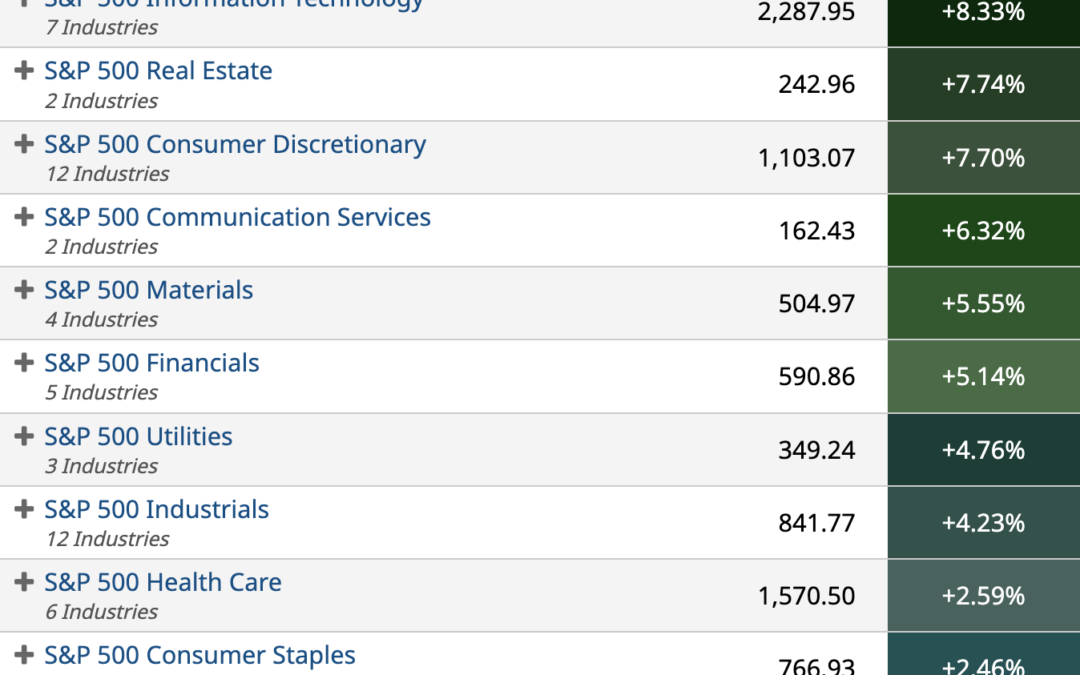

Yesterday’s Sector Performance

Technology had an amazing rally on Thursday, as did many sectors.

Energy was the weakest, although still up nicely.

Five-Day Sector Performance

Materials are still leading on the weekly, but that may change soon.

Energy stocks are in the red for the week.

ETF Trade Watch

Technology Select Sector SPDR (XLK)

Real Estate Select Sector SPDR (XLRE)

With the markets having the biggest one-day rally since the bear market started, higher prices would seem to be inevitable. Most sectors will likely perform well.

However, taking a look at Thursday’s performance and one would think the XLK and XLRE could be two of the top beneficiaries.

Good luck!