Watch Steve do it…

Yesterday Steve Smith hosted a live event in which he presented his highly successful Earnings360 service.

In this webinar, Steve Smith discussed his unique approach to profitably trade earnings.

He also placed a live trade in Taiwan Semiconductor which was closed this morning for 75% gain overnight.

With over 25 years of trading experience, including 8 years as maker on the Chicago Board of Options, Steve uses options to harness the predictable price behavior that come before and after a company’s earnings report; most notable the decline in implied volatility following the release, what he refers to as Post-Earnings Premium Crush or PEPC.

By harnessing PEPC and using options spreads his Earnings360 service has produced consistent double digits returns during the past 25 quarters (6+ years) while minimizing risk.

In this video Steve explains the concepts, shows how he structures a variety of strategies.

See a special offer to trade Earnings with Steve here.

This service does NOT take wild shots by purchasing out-of-the-money “lottery tickets” hoping to hit a directional home run.

By taking an option-centric approach with a focus on predictable behavior of implied volatility he’s able to produce more consistent but still highly profitable returns.

All trades have defined limited risk and most trades are held for just one day!

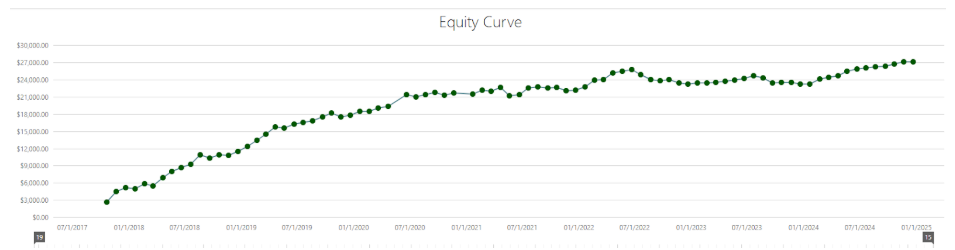

Track Record:

- Six years (22 winning quarters out of 25)

- 748 trades

- 468% total return

Why Play Earnings?

Most of the time stock prices are random walk towards points unknown. Sentiment, fleeting news narratives and cursory analysis are applied to explain the various ups and downs. But they are mostly ascribing reasons after the fact.

But four times a year the truth about a company’s profitability, or lack thereof, is revealed causing stock prices to react immediately and often dramatically. I’m talking about quarterly earnings reports; these reports provide an unvarnished accounting of companies’ state of business and its immediate prospects

In most cases I do not care if the underlying shares move up or down. I want to capture the high probability of the reversion to mean in the options price.

In fact I mostly disregard whether earnings will meet, beat or be greeted with a sell the news reaction.

Post Earnings Premium Crush (PEPC)

But there is one variable that we can reliably measure, predict and profit from.

This post- earnings premiums crush (PEPC) occurs regardless of the stock’s reaction up or down. The predictability of implied volatility is the single greatest edge we have in trading earnings.

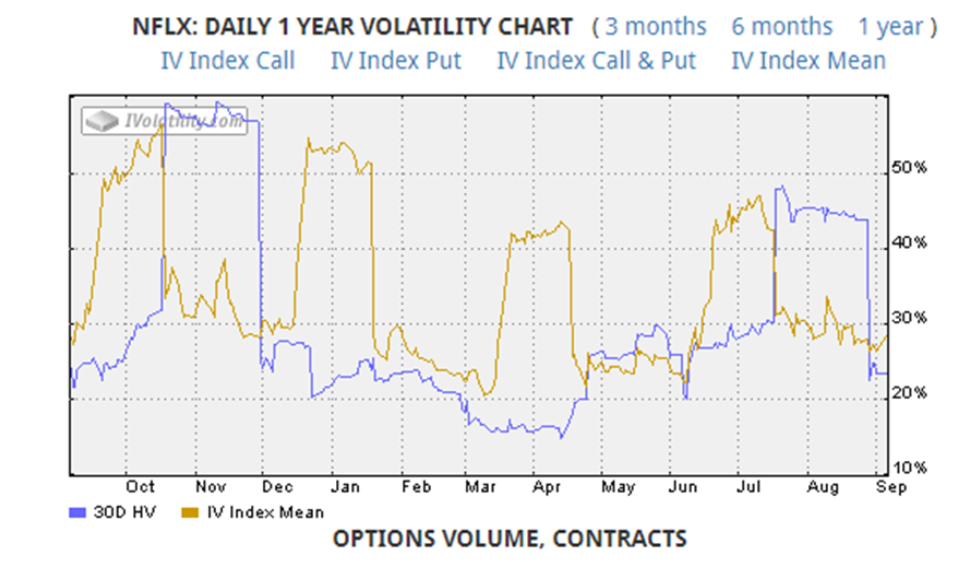

Can you see the pattern of implied volatility Netflix?

Below shows the realized or historical volatility (yellow line) versus the implied volatility (blue line) of Netflix over the course of a year.

It’s not hard to guess on which dates the quarterly earnings were reported is it?

The predictable increase and then decline, or reversion to the mean if implied volatility is what we will harness to produce consistent profits.

This is the basis of how Earnings360 harnesses the predictable post earnings premium crush to produce consistent profits.

I’m particularly excited about this quarter as I expect an especially high -number of companies’ shares to respond with outsized moves. This quarter should present us with opportunities for large profits in a very short period of time.