Market Recap For March 21st, 2022

In yesterday’s Spotlight, it was stated that traders should be prepared for a pullback after such a large rally. Monday seems to be confirming that,

Odds would seem to favor a continuation of Monday’s weakness, but the market is certainly allowed to rally further, should it deem to do so.

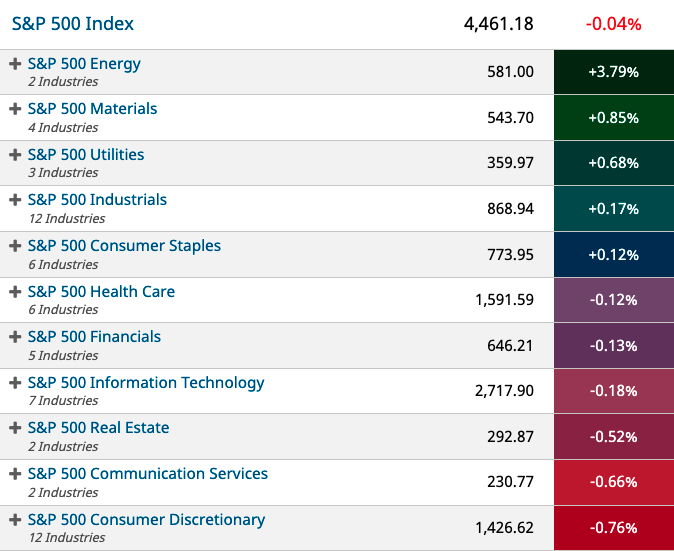

Yesterday’s Sector Performance

Energy finally rebounded to the top of the market,

Services and Discretionary were the weaker sectors.

Five-Day Sector Performance

Discretionary is still on top of the week.

Energy moved out of the cellar, replaced by Utilities.

ETF Trade Watch

SPDR S&P Oil & Gas Exploration & Production (XOP)

Energy Select Sector SPDR (XLE)

Even though markets may very well be gearing up for a pullback, but oil appears to be revving back up again.

A couple of ETFs to consider for bullish trades could be either the XOP or XLE, although they are similar trading vehicles.

Good luck!