2 options trades this week I’m watching…

And much more

Hi, it’s Steve Smith.

Today I’m going to discuss some broad themes and expectations for 2025 and how I plan to trade them.

None are unknown or particularly contrarian and that’s ok; making money consistently in trading is often more about identifying the market environment than making bold predictions.

I have a basically bullish outlook for 2025 but of course comes with some caveats and concerns. I’m an option trader, so hemming and hedging is in my nature.

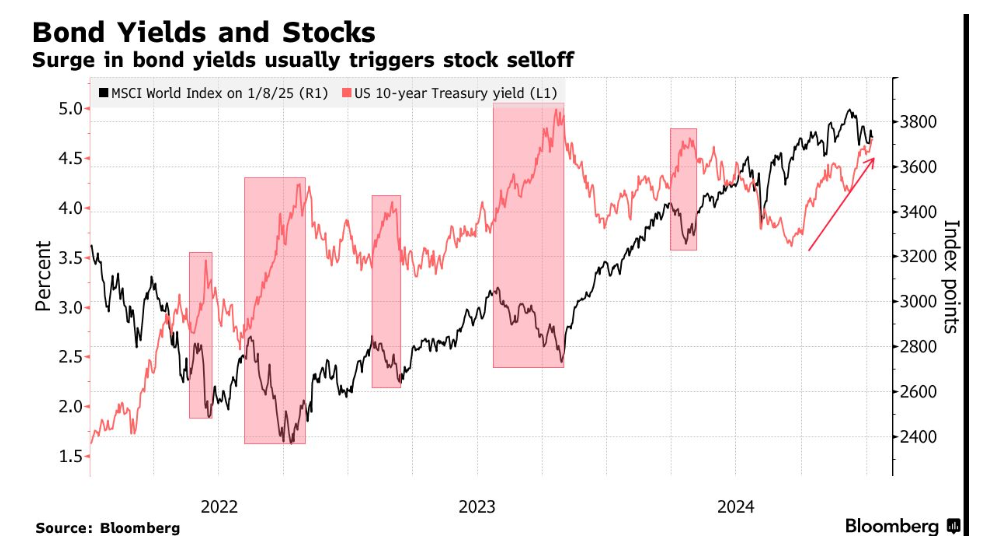

- Interest rates. If inflation remains sticky or reaccelerates and bond yields continue their trajectory higher it will likely create headwinds for stocks. The 10-Year, currently 4.7%, has risen 100 basis points even as the Fed has cut rates by 100 basis points September. During the December FOMC meeting Powell pretty much admitted he has no idea what he’s doing ( he said “It’s like driving on a foggy night or walking into a dark room full of furniture”) and only cut rates because that’s what he had signaled at the prior meeting. This does not instill confidence.

Indeed, over the past few days as rates moved to 8 month highs stocks have struggled. A spike above 5% would cause further indigestion for equities. That said, the pace of rate increases is equally as important as the absolute level.

The Plan: I think if rates stabilize here, or even drift up towards 5%, corporations and individuals will make the adjustment. I’d use any further short-term dislocation as a buying opportunity for both stocks and bonds.

The pullback over the past two weeks, especially the pricking of the incipient bubble in speculative areas such as quantum computing, has been healthy after a big post election run.

I’d become a more aggressive buyer if we approach the pre-election level of SPY near $576. This seems an obvious and good risk/reward entry point.

- Market concentration, in which the 10 largest stocks now account for some 32% weighting in the S&P 500 Index and over 50% of the Nasdaq 100 Index is at its highest level in over 40 years.

I’m not overly concerned about this for two reasons; the composition of the market has been trending in this direction for the past 5-6 years and is actually rational- these are the companies experiencing the greatest EPS growth.

Which speaks to the concern of valuation. Many look at the S&P’ trading at a 23x earnings multiple and feel it is rich especially on a historical basis. But I think it’s misguided to compare mega cap tech, which are mostly asset light and have profit margins in excess of 50% to the old industrial/manufacturing ( oil, railroads, steel) that used to carry the biggest weightings which had sub 10% margins.

You can see the dispersion in performance between the SPY and and the equal weight RSP over the past year.

The Plan: I will not get lured into looking for a major or sustainable rotation into small cap/value names. The structure of the market and money flows have changed over the past decade.

I might look at a few sector ETFs such as financials (XLF) or energy (XLE) but I don’t think there will be a wholesale movement out

- Volatility. The incoming Trump Administration is mostly business friendly. But he is also notoriously unpredictable. We saw in his first term how off the cuff comments can cause knee jerk reactions and we are seeing it again already; on Wednesday morning futures were indicated higher but quickly dropped nearly 1% after Trump said he’s use bigly tariffs against Denmark to get control of Greenland 😉

The market doesn’t like uncertainty. But volatility is opportunity, especially in the options market.

The Plan: The advent of daily or 0DTE options in various index products such as SPY and QQQ offer great opportunity to capitalize on short term moves and the accompanying spike in implied volatility.

This does not mean I buy puts or calls with one day until expiration. Rather I sell options with one day until expiration to capture premium and time decay while buying an option with 4-5 days as a form of protection. I’ll get into the specifics of the strategy in another post but it’s basically a short term calendar spread.

A Few Recent Trades

Let me leave you with actionable trades of two positions I recently established for the Options360 Service.

Both are bullish, both use diagonal spread and both are based on similar chart patterns.

The pattern is simple; a big gap up following an earnings report, followed by an orderly low volume consolidation into the gap which now represents support.

Okta (OKTA) we added last week when shares were around $80. It dipped a bit further but has now had a nice pop.

Docusign (DOCU) we added on Monday with shares around $90. Slightly premature but today’s move from red to green is encouraging.

If you want to see how Steve exits these positions…

You’ll need to be a part of Options360.

Read on:

More from Steve Smith:

If you want 3 months of Steve Smith’s Options360 service for free… see how below

You could start generating income each month with Steve’s service, but also Adam Mesh’s options service.

Adam has 7 options trades open… one he’s had open since June… because he’s just collecting steady income every single week from them.

As the stock goes sideways or up, he collects more options gains, but also sells weekly calls to generate premium in the interim.

For 2024 and 2025, it’s Adam’s #1 way to generate income from my portfolio.

So, if you have profits you’re sitting on…

Or, you’re looking to simply generate steady income — income that’s 10-20x higher than you’d get at the bank or bond or CD — you’ll want to see these high probability trades.

The win rate is over 83%… that’s how consistent we’re winning

[See how to trade options for income and get 3 months of Options360 free]